2020 has challenged our industry in ways previously unknown. We began the year expecting our biggest challenge would be continued growth of deposits at reasonable rates. Today, we face three challenges: a prolonged low-rate environment with continued margin compression, the challenge of keeping branches open and serving our communities, and an increasing number of customer transactions moving to the digital arena.

Much has been written lately regarding the validity of the branch in the current environment. Has community banking been changed forever based on consumers’ digital behaviors? Possibly. Is some of this for the best? Definitely. Does the branch still have value? Absolutely! Community banking is about community support. It is about being present and accessible. Unless your strategic plan is to shutter your branches and vacate your communities, we encourage you to keep reading.

Margin compression is real. So, what can you do? You can offset a portion of it by shifting your deposit mix toward low- or non-interest-bearing deposits. Low-rate deposit relationships should always be the foundation of any strategy looking forward, and community bank data shows your branches are the key to shifting your deposit mix.

While new core relationships are strategic in managing and maintaining your margins, they are also a key driver of additional non-interest-income (NII), a critical component in the shorter term. Financial institutions must increase their NII to offset some of the interest income/margin side challenges. To accomplish growing those new relationships, you must do three things:

- Bring more new customer relationships into your organization.

- Serve all your customers better than any other financial institution has previously.

- Make them loyal customers by increasing relational intensity over time

The Loyalty Factor

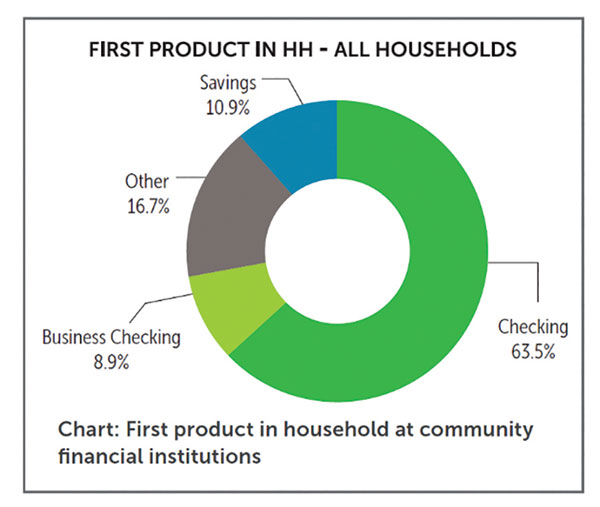

Bringing in more relationships should be data-driven, and the data shows the checking account and the branches are key. Data from over 100 community-based financial institutions and over 2.5 million households/businesses illustrate this point.

The vast majority, or 72%, of consumer and business relationships at community financial institutions begin with a checking account. In other words, the checking account provides the best opportunity to create customer loyalty; it is the gateway to primary financial institution status (PFI), allowing your bank first right of refusal on other products and services 68% of the time. In addition, customers who have checking accounts with your bank outpace other customers regarding products and services, generating additional NII.

Even during the pandemic, and with limited access to community-based financial institution branch networks, client data shows over 90% of new PFI relationships have come through branch channels (in-person, appointments, drive-thru, telephone). The value of your branches cannot be ignored.

The more customer loyalty you build, the more interest income and NII they generate. Consumer and business customers have almost six products and services with their primary financial institution – the math works. Most importantly, the more loyal customers you have, the better your bank will perform, now and in the future.

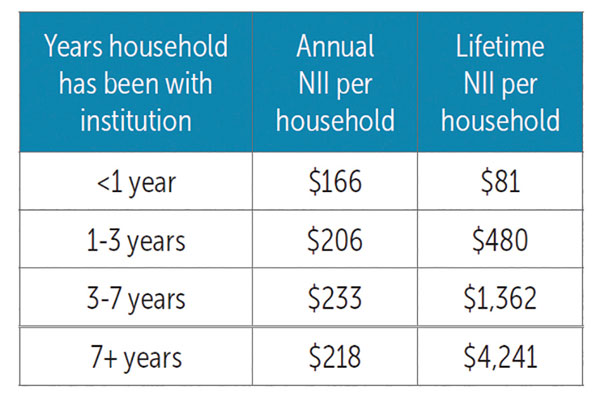

Segmenting data from several million customers based on their tenure with the community financial institution shows that loyal customers, over their lifetime, generate dramatically more NII.

In addition, annual NII contribution peaks once customers have been with their PFI for a few years. Further analysis of the data explains why the checking account revenue stream does not continue to grow. Customer age demographics drive it. In general, more mature customers tend to stimulate more checking deposits than checking NII.

Creating Loyalty

Your organization must position itself to capture new customers when they are ready to switch; this creates customer loyalty. The data shows up to 12% of current retail and business customers are consistently changing financial institutions. A recent study published by The Financial Brand indicated this number could be as high as 22% post-COVID, driven primarily by the failures of the big banks to adequately serve customers during the pandemic.

So how do you position your organization for growth?

- Checking Product: You need to get your checking product right. A confusing product does not create value or in turn, develop customer loyalty.

- Processes: You must remove barriers. Your account-opening policies and customer identification program (CIP) practices often inhibit growth rather than encourage it. Read them for yourself.

- Promotion: Community financial institutions have an audience that needs to be maximized and optimized within a defined footprint. If your bank is not using targeted, data-driven print and digital marketing to grow PFI customers, you are missing too many growth opportunities.

- People: Equip your team members with the skills and the product knowledge to develop authentic relationships with customers – customer loyalty is created through customer connections.

The Bottom Line

- To create loyalty, get the new customer first.

- The checking account is the key to the PFI relationship.

- Once you have the customers, products, processes, promotion and people move up the loyalty ladder.

- The longer customers stay, the more they will contribute.

- You can do much to accelerate that growth.

- Customers are not all the same. You must understand their lifecycle journey with your bank.

As with any strategy, there is no silver bullet; but rather, your bank should be looking for a long-term loyalty payoff.

Achim Griesel

Sean Payant

Achim Griesel is President and Dr. Sean Payant serves as the Chief Strategy Officer at Haberfeld, a data-driven consulting firm specializing in core relationships and profitability growth for community-based financial institutions. Achim can be reached at (402) 323-3793 or achim@haberfeld.com. Sean can be reached at 402.323.3614 or sean@haberfeld.com.