Banks must look forward to when the economy stabilizes, employment returns to normal levels, and people embrace everyday routines. To secure a long-term and stable customer base, banks will need to grow by catering to a younger demographic while still providing superior service to their clients.

Throughout the pandemic, households have accumulated significant savings. Banks, awash in deposits and with interest rates still at low levels, have increased lending while working through the many challenges of the past year, including maintaining services to existing customers. Despite the pandemic’s operational obstacles, most financial institutions have managed to attract new customers, further aiding the growth in asset size for institutions nationwide. The Paycheck Protection Program (PPP) has also contributed substantially to this growth.

While the economy gradually adjusts from heavy government stimulus and returns to growth levels seen before the pandemic, banks adapt to new ways of serving their customers. Beyond the logistical challenges of in-person meetings and modifications to branch operations to maintain service quality to customers, banks have mostly resorted to bolstering the use of digital channels to continue to operate and thrive throughout the pandemic.

The rapid adoption of digital banking has exacerbated the need for banks to have responsive and innovative digital and mobile offerings. Among a rising set of customers – those who may not have interacted with their financial institution in this manner before – the pandemic accelerated the use of such channels. For banks tuned into their user base, it is evident that effective digital channels must be a part of current and future strategy, a contemporary path to service quality for those banks, and they are prepared to invest in it.

Notably, service quality is primarily the result of the management and philosophy of the bank. As with most any business, customers want to see that their bank cares, values the customer relationship and understands needs, regardless of where and when the interaction occurs. If banks embrace this intense customer focus, they will forge new paths to service quality. One ICI consulting client kept its branches open and boldly stated, “We never had to ask our customers to make an appointment to visit a branch.”

In part, service will only be as good as the software tools banks use to implement digital banking. Therefore, a comprehensive survey of the institution’s requirements and a rigorous evaluation of current offerings is demanding the attention of bank executives to be competitive in the market, responsive to existing customers and in a position to attract new ones. Banks must look forward to when the economy stabilizes, employment returns to normal levels, and people embrace everyday routines. To secure a long-term and stable customer base, banks will need to grow by catering to a younger demographic while still providing superior service to their clients. Attracting and servicing future generations will require innovative new products and services delivered through digital channels. Banks must also anticipate the likely challenges ahead and prepare for a time when growth levels; when this happens, one of the most dependable actions will be to control costs.

With few exceptions, data processing expenses are among the top three expenditures – along with salary and benefits, premises and fixed assets – that a financial institution incurs on an ongoing basis. Data processing expenses, including an institution’s spending on core processing & ancillary systems, are easily addressable cost reduction targets.

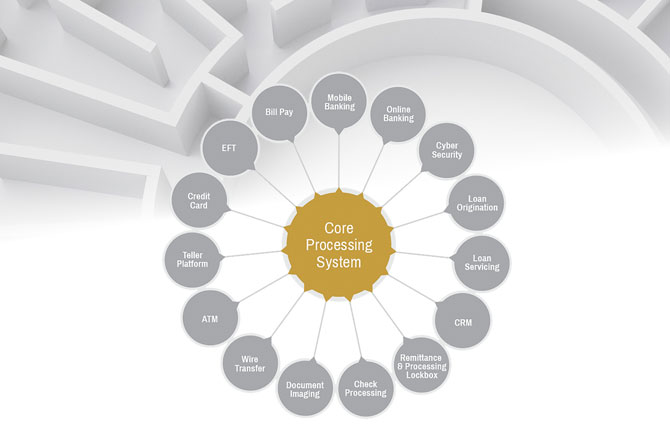

The ancillary systems are vital applications surrounding and interacting with the core system. They include essential services, such as ATM/EFT, credit card, online banking, mobile banking, loan origination and servicing, payments, wire transfer, cash management, document management, BSA/AML, IT security, check processing, among others. These ancillary systems are as critical as the core system because they support the institution’s key business functions and serve as touchpoints for customers.

We also see banks aggressively pursuing new strategies to expand and emphasize digital channels – many that shrewdly started such projects before the onset of the pandemic. In modernizing their Digital Channels, banks are not only reaching more customers, but they are also doing so with more innovative and integrated applications while potentially reducing data processing spending. Furthermore, banks are making a sound investment in what will become a vital channel to serve customers in the future.

Banks are also changing the digital channel to address a shifting mix of commercial or consumer business, integration to the core system, and variable vendor product and support plans. When reviewing data processing systems contracts, ancillary grouping products serving the digital channel with other essential applications – especially the core system – will naturally increase the bank’s purchasing power and negotiation leverage. We commonly recommend this holistic approach to our clients as it tends to yield the best results.

Banks will provide excellent service to their customers and shareholders by closely examining and monitoring data processing costs. There is a wide range of pricing models in the industry. The best way to gain insight into comparable market prices is to conduct a competitive evaluation of alternatives. The banks taking time to start the process 24 to 30 months before contract expiration will see the best outcome in finding solutions that effectively serve customers and address the institution’s business requirements at the best price and terms.

Banks can achieve this goal by either negotiating new technology contracts or renegotiating existing ones. While some executives deem the technology review process painful, it remains an integral part of appropriate due diligence by the institution in a vital area that is the foundation of efficient and cost-effective operations. Unless the bank enjoys annual contracts, most banks or credit unions maintain multi-year contracts with core processing and ancillary systems vendors. With the opportunity to review alternative solutions and address costs only every five, seven or 10 years, it is wise to take advantage of the typical contract cycle to review these business-critical applications carefully. If not then, when?

Since 1994, ICI Consulting has been a leading bank and credit union advisor nationwide. ICI is a consulting firm supporting financial institutions by providing core processing assessments, gap analyses, vendor evaluations, contract negotiation and conversion services. ICI Consulting is well known for saving clients time and money during core processing and ancillary systems evaluations and negotiations with the providers of these business-critical solutions. They can be reached at ici-consulting.com.

Bryan T. Di Lella has more than 30 years of information technology industry experience in the financial, regulatory and federal government sectors. Bryan earned his Bachelor of Science degree in Computer Science at Saint Bonaventure University and his Master of Business Administration degree from the George Washington University. He is certified as an Arbitrator with the Financial Industry Regulatory Authority (FINRA) Dispute Resolution Board of Arbitrators. Mr. Di Lella can be reached at bryan.dilella@ici-consulting.com.