For better or worse, State and Federal laws are constantly changing regarding the banking environment. Occasionally, some changes will go under the radar. In this article, we recap the WV Senate Bill 438 changes and what you can expect. Senate Bill 438 is an act to amend and reenact §12-1-5 of the Code of West Virginia and to amend the Code by adding Article 12-1B, otherwise known as the West Virginia Security for Public Deposits Act (the Act). The Act will ultimately impact all designated state depositories that hold public fund deposits. A published list of designated state depositories is listed on the West Virginia State Treasurer’s website at the bottom of the Banking Services tab.

Legislative Intent

The purpose of the Act is to allow designated state depositories to pledge collateral for all public deposits through a pooled method and Public Deposits Program. The West Virginia Legislature intends that designated state depositories participating in the Public Deposits Program will be authorized to secure public deposits through the pooled method as an alternative to forms of securing public deposits charged under other sections of the Code of West Virginia.

The West Virginia Legislature anticipates that authorizing designated state depositories to secure public deposits via the pooled method will lower the overall cost of public deposits and make public banking contracts in West Virginia more desirable to financial institutions.

Collateralization of Public Funds

Going forward, the following methods will be allowed for collateralizing public deposits: the Dedicated Single Bank Method and the Multibank Pooled Method.

The Dedicated Single Bank Method is securing public deposits without accepting the contingent liability for the losses of public deposits of other designated state depositories as provided in §12-1-5. This method includes:

- A 102% collateral pledge for all public deposits over the FDIC, IntraFi/CDARS/ICS coverage amounts

- A weekly reporting of public deposits through the State Treasurer’s Office Online Collateral System

- No liability for losses of public deposits held by other public depositories

The Multibank Pooled Method is the securing of public deposits by accepting the contingent liability for the losses of public deposits of other designated state depositories that choose this method. This method includes:

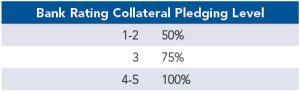

- Collateral pledging levels of 50%, 75% or 100% will be determined by nationally recognized financial rating services and will be required for all public deposits over the FDIC, IntraFi/CDARS/ICS coverage amounts.

- A weekly reporting of public deposits through the State Treasurer’s Office Online Collateral System

- Liability for proportionate share of losses of uninsured and uncollateralized public deposits held by a designated state depository in default.

Requirements and Responsibilities

Once designated state depositories select one of the two aforementioned collateralization methods, the designated state depository will be responsible for pledging collateral at the required amount with a designated Qualified Escrow Agent for holding and safekeeping in benefit to the State Treasurer’s Office. Both designated state depositories and qualified escrow agents must report weekly to the State Treasurer’s Office via the State Treasurer’s Office Online Collateral System. If desired, designated state depositories may change from one collateralization method to another each quarter.

There are no exemptions or exceptions to the Act, and all public funds must be collateralized through the State Treasurer’s Office. Additionally, all parties must sign appropriate forms provided by the State Treasurer’s Office. Compliance with the Act is required while a designated state depository holds any public funds. Failure to comply with the Act may result in penalties or the rescission of authority to receive public funds.

State Treasurer’s Office Online Collateral System

The online collateral system will allow designated state depositories to have access to and see their public depositor’s accounts, will let qualified escrow agents see securities held by their depositories, will enable depositors to have access to see their account balances and will allow for balances to be uploaded weekly.

The Public Deposits Program is expected to be operable on or before March 1, 2024, and will be administered by the State Treasurer’s Office.

Suttle & Stalnaker is ready to help you. If you would like more information on how this applies to you, contact Kelly Shafer, CPA, at kshafer@suttlecpas.com or (304) 343-4126. You may also contact Josh Sharp, CPA, at jsharp@suttlecpas.com or (304) 343-4126.