You already know what your vocal customers think. Those who love you tell their friends about you. Those who are frustrated with you tell you so, giving you the chance to fix the problem.

The customers you should be concerned about are the silent majority. They are the most vulnerable to the marketing messages of your competitors. So, how can you change the narrative and turn those customers into raving fans?

Customers switch financial institutions for a variety of reasons; some we can control, others we cannot. As bankers, we often do not see things through the lens of the customer, a thing we can control. When you are closing more accounts than you are opening or are at net zero, it is time to reevaluate three key areas: fees, culture and service.

Numbers That Matter

First, move beyond a narrow focus on fees themselves. The metric we need to drive is total profitability. The profitability formula is simple: Total Profitability = Average Profits per Household × Number of Households.

When it comes to maximizing a bank’s overall profitability, the focus is often on profits per household alone. The problem with this approach is that averages only tell you so much. What banks should focus on is the other half of the equation: the number of households. Rather than charging current customers more, you should increase the number of households. In doing so, your total profitability will soar. Most FIs can handle many more customers with little impact on operating costs. With a strategic approach to growth, community banks can double their number of new-customer acquisitions and sustain that growth for as long as they like.

Consumer-Friendly Approach to NII

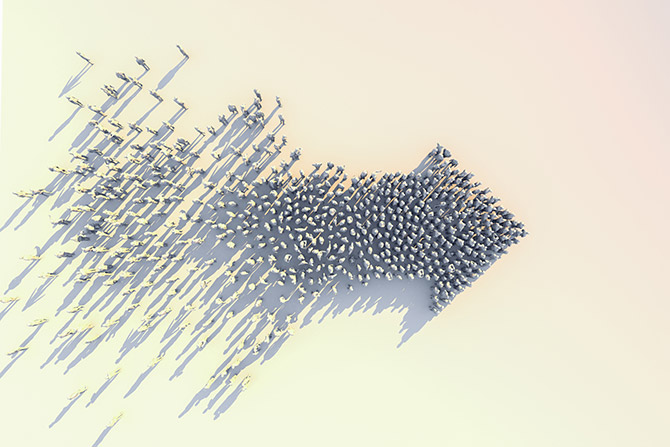

For almost a decade, “free” accounts were almost universal. Fast-forward to today, and banks have reversed course by implementing a wide range of fees. What we have found is that not all fees are created equal. In fact, fees rank as one of the most common reasons people switch financial institutions. We are all familiar with the fees that anger customers, from monthly service charges to minimum balance fees. These you can and should avoid. Instead, focus on fees that drive profitability.

The three big fees in retail banking are overdrafts, interchange and value-added products. While some uncertainty remains over the future of overdraft fees, too many institutions simply stopped providing this valuable service rather than implementing customer-friendly practices.

Over the last three years, interchange income has outpaced overdraft income and will continue to be a significant profit driver. Interchange is not directly paid by customers, so there isn’t the sensitivity about it. Banks should prioritize increasing debit card adoption and ensuring customers are using cards frequently. Simple targeted campaigns can increase usage with remarkable ROI. Furthermore, the instant issuance of debit cards has a direct correlation with both usage and spending. Perhaps it’s time to reevaluate that opportunity.

Gaining popularity, value-added products afford another way for us to provide extra benefits for a reasonable fee. Our data suggests 10-15% of new customers will opt for that product when offered as an option. Too many institutions have attempted to maximize this kind of fee by force-migrating customers or pushing the product onto those who do not want it. The result is a short-term burst of income but long-term damage in the form of high attrition rates and unhappy customers. The strategic implementation of this product is key to its success.

Building a Customer‑Centric Culture

Bankers believe we are great at meeting the needs of our customers. The reality is that consumer expectations are being driven by retailers like Chick-fil-A, Amazon, Zappos, Disney, Starbucks and others. What sets them apart? They have built a culture that empowers their employees to delight customers by anticipating and then meeting their needs. Empowered employees create extraordinary experiences that drive customer loyalty, referrals and sustainable growth.

So, what does it take to bridge the expectation gap? First, it starts with training — equipping employees with product knowledge and simple sales tools. When employees feel fully confident in what they are offering, they naturally become stronger advocates for the products.

Second, it requires a cultural shift — reframing sales as an extension of exceptional customer service. By actively identifying customer needs and offering solutions, banks can not only enhance customer relationships but also foster long-term loyalty and trust.

The elephant in the lobby is that our self-perceptions are at odds with customer feelings. Rather than expecting customers to understand our banker ways, let’s view the world through their eyes. It will result in happier and more loyal customers — and more profitability, too.

Robb Rempel is executive vice president at Haberfeld, a data-driven consulting firm specializing in core relationships and profitability growth for community-based financial institutions. Robb can be reached at (402) 770-7519 or rrempel@haberfeld.com.