The Fraud Odyssey

The criminal ring targeting victims for identity theft, check fraud, loan fraud and auto theft were all connected by illegal drugs. But they used their knowledge of the digital world to monetize their victims in new and creative ways. Not unlike the 66 West Virginia residents charged in a large-scale drug ring indictment announced on Jan. 24, 2024, these co‑conspirators brought more and more folks into their drug and fraud ring.

The Story of One Victim Highlights a New Peril to Banks

To preserve his identity, the following individual’s name has been omitted.

He served as a WWII pilot in the Army Air Corps when he was 18 years old, flying multiple missions and training new pilots as the war waged on for more years than anyone thought. He returned stateside after the war ended, married his sweetheart and started a family and a Heating and Air Conditioning company with job sites throughout the Midwest.

He was actively working at his company until his 92nd birthday. He wasn’t as strong, but he still had the wisdom and respect of his employees and customers. At 92, he said, “It’s time to retire.”

Then came the daily coffee and breakfast at McDonald’s. The table of veterans surrounding the breakfast McMuffins and telling stories was a fixture for all the staff and customers, so much so that on his 98th birthday, the local TV news featured him on the nightly broadcast, and McDonald’s organized a tribute breakfast and invited the community.

Unfortunately, his health took a turn down that same year, and he moved into the home of his daughter and son-in-law. He didn’t sell his ranch home and five acres, as he still went down to the old house occasionally to tinker.

Unbeknownst to him, a criminal ring was watching the home as well. They saw it unoccupied most of the days and pounced. Unknown to the family, following the instructions provided to a group of burglars, they broke into his unoccupied home and stole financial documents and old checkbooks that the family did not know were still in the house. Within hours of the burglary, online inquiries and credit bureau inquiries took place. The fraud fuse was lit.

At a local bank, the drive-through teller became suspicious of a check being presented as if written by their 98-year-old customer. The payee claimed it was for “painting a house.” They called the customer and spoke to the daughter (who had been added to the account). Neither she nor her father knew anything about the check or the payee. The bank called the police, but the perpetrators took off before they arrived.

A seven-month odyssey of fraud then ensued, highlighting many of the macro issues facing banks challenged by the marketplace to make opening accounts and transacting business online faster and faster, with less and less friction. And a criminal justice system that is not equipped or inclined to help.

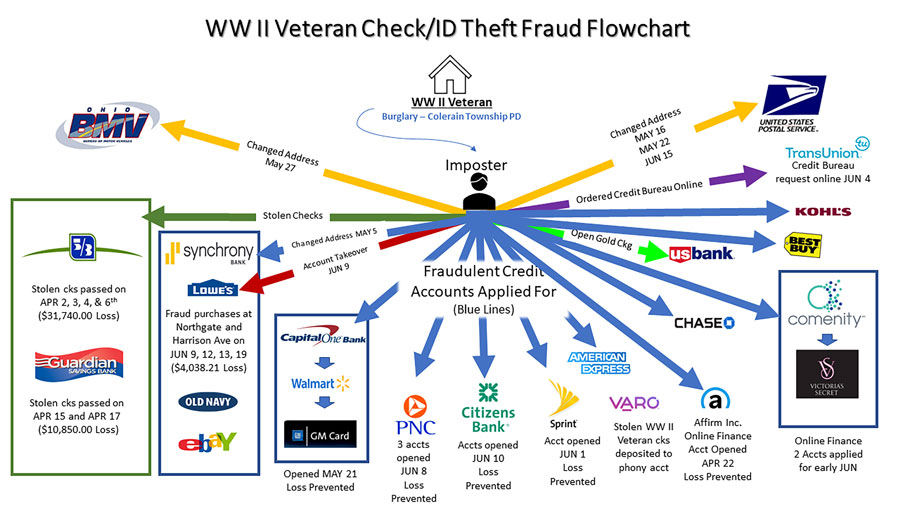

Chart 1, shown below, was created to try to persuade the FBI to take the case due to the overwhelming interstate nature of the case, the complexity, and the continuation of the fraud attempts as the victims fought the fraud daily, not unlike “Whack-A-Mole.” Even with the victim being a decorated WW II veteran pilot, the one time he called for help from his country, they turned him away, saying, “We can’t work the case unless the loss exceeds $1 million.” The family was left to fight banks, credit card companies and lenders opening accounts using the victim’s name and personal identifiers at a record pace while the perpetrators continued their fraud unabated.

Attempts to report the fraud accounts to financial institutions, which were opened in mere minutes, often took days and multiple phone calls. In one instance, a bank refused to take a fraud report until they could identify the victim through a driver’s license and video face identification of the victim. When the verification camera link did not function properly, the bank asked the now 99-year-old to go outside and have his daughter film him via the fraud reporting portal. Only after their facial recognition system confirmed his photo was the same as the driver’s license the victim supplied would the bank take a fraud report. This process took more than three hours to complete. The crooks had opened the account in mere minutes.

Chart 1 — Reflects Change of Addresses at BMV’s, Postal Service, Checking Acct Fraud Accounts, Forged Checks, Credit Unions. Chart provided by Jim Rechel, President, The Rechel Group Inc.

Ultimately, a dedicated lieutenant in a local police department worked with the family, and a U.S. postal inspector I knew worked with me to identify the perpetrators. After two years of continuing fraud, eight people were later identified and were prosecuted in state courts. They received six-to-eight-year sentences. One of the main participants has a criminal record, including drug dealing and homicide, and he knew how to stay in the background. Fortunately, he was convicted in other courts of criminal activity unrelated to this ring and is in prison for an extended period.

Three of the members of the fraud and drug ring are all serving their sentences in the same prison. Time will tell if this incarceration serves to change their ways or serves as a launching pad for future fraud schemes as they conspire daily on the prison grounds.

What the Investigation Results Reveal for Bankers

While the fraud illustrated previously is a solitary case, in a world of millions of fraud cases per year, it reflects macro changes taking place in the world of fraud, specifically the following:

- The increasing knowledge and sophistication of the criminal rings targeting banks and their customers.

- The speed at which criminals operate to monetize their stolen information, documents and PII.

- The speed at which bank transactions move. (Think Fed Now and other FED changes to “Instant Payments” initiatives.)

- The inability of law enforcement and the criminal justice system to respond to the fraud epidemic.

- The evolution of “street criminals” to highly organized “cyber-savvy fraud rings.”

- The overall moral decline in the marketplace and its implicit invitation to get “easy money.”

- The identification and authentication of identities for account openings and transactions.

What Bankers Need to Address

Identifying steps your bank can take to address the rapid changes taking place will involve:

- Investments in technology and fraud personnel equipped to use predictive modeling and AI.

- Customer dashboards incorporating transaction and maintenance activity as part of fraud strategy.

- Development of a fraud strategy, to include the level of support and advocacy the bank will provide to victim customers.

- A systematic approach to the consolidation of fraud methods in real-time to respond to threats more quickly.

Jim Rechel is president of The Rechel Group Inc., a leading risk consulting business providing organizations with fraud risk analysis, fraud prevention, detection and investigation services. He is a former banker and FBI Agent and now a fraud consultant who has overseen thousands of investigations with losses that ranged from $2,000 to $200 million and involved complex international criminal rings, government corruption and suicides/homicides, which were the direct result of the fraud schemes. More importantly, he has overseen investigations of modest dollar amounts that have devastating impacts on the customers and businesses that bankers serve.

Interested in learning more about bank security or hearing from Jim Rechel in person? The WVBankers Bank Security School offers a comprehensive educational program tailored for both novice and seasoned Security Officers. Learn more by visiting www.wvbankers.org for our Calendar of Events.