In this article, we will review the top consumer compliance issues identified by the FDIC in a recent supervisory report and examine upcoming trends that are expected to gain attention from examiners during the latter half of 2024 and into 2025.

The FDIC’s consumer compliance supervisory report released in the spring of 2024 highlights trends cited by examiners for the most recent calendar year. The results are summarized from nearly 900 consumer compliance examinations conducted during 2023. The FDIC’s consumer compliance exams use a risk-focused methodology, resulting in the most frequently cited violations involving regulations representing the most significant potential for consumer harm.

2023 Consumer Compliance Highlights

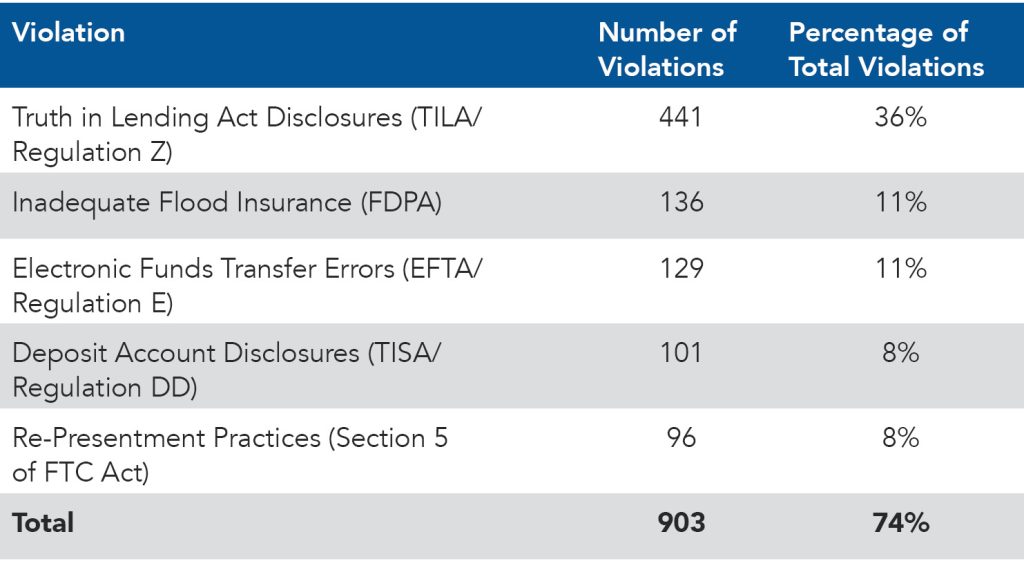

Trends in consumer compliance exam citations essentially center around five areas identified in the chart below. These areas comprised 903 of the total 1,227 violations and made up 74% of violations cited by examiners in 2023.

Notably, violations of the Truth in Lending Act comprised the most significant portion, at 36% of the total citations during the year. The most common violation, comprising 9% of total TILA violations, related to inaccurate or incomplete disclosures of closing cost information on the closing disclosure document.

Violations were also noted under Regulation E of the Electronic Funds Transfer Act. Commonly cited issues included inadequate investigation of electronic funds transfer errors, failure to report the results of the investigation to the customer and errors that were not corrected timely, with these areas making up 46% of EFTA violations.

Violations of Section 5 of the Federal Trade Commission (FTC) Act made up 8% of total citations. The FDIC frequently cited institutions for charging multiple non-sufficient funds (NSF) fees for the re-presentment of the same transaction, while the disclosures did not clearly describe the institution’s re-presentment practice. This violation represented 58% of all FTC Act citations.

A Look Ahead

The issues noted by examiners in the 2023 supervisory report influence several consumer compliance trends expected to impact the regulatory landscape in the coming year. The following are a few of the areas anticipated to garner regulatory attention:

Fair Treatment of Consumers: Expect a continued emphasis on consumer treatment, including transparency in fees and product terms and conditions. Examiners are scrutinizing practices to ensure they are not misleading to customers. This is seen most notably in the recent focus on overdraft fees and re-presentment practices.

Customer Complaint Practices: In addition to exam results, customer complaints drive regulatory changes. Examiners are focusing on how institutions handle customer complaints with an expectation for banks to have effective mechanisms in place to address concerns promptly and fairly. In a look to the future, the role that conversational AI and other automated platform solutions will play in handling customer complaints will likely start to make its way into regulatory enforcement.

Third-Party Risk Management: An increased reliance on third-party vendors for a variety of services creates concern from examiners about risks associated with these relationships. Data security and compliance with consumer protection laws take center stage. It is worth noting that the FDIC pointed out in the consumer compliance supervisory highlights that there has been a 5% increase in consumer complaint volume associated with third-party providers from 2022 to 2023. Many of these complaints are linked to vendors providing credit card servicing, deposit processing and error disputes.

Environmental, Social and Governance (ESG) Factors: There is an increasing regulatory interest in how banks integrate ESG factors into their operations. For example, examiners may begin taking a closer look at the environmental and social impacts of bank lending practices.

Artificial Intelligence (AI): Banks are gradually using AI and machine learning for various purposes, such as credit scoring and fraud detection. As AI gains popularity, regulatory measures are expected to focus on ensuring that these technologies do not violate consumer protection laws or result in discriminatory outcomes.

Cybersecurity: Cybersecurity continues to be a main focus for examiners as digital banking becomes increasingly prevalent. Banks are expected to implement robust security measures to safeguard customer information from cyber threats and data breaches. Examiners remain focused on prevention, detection, response and recovery capabilities in response to cybersecurity threats.

Compliance Culture and Governance: Examiners are paying closer attention to overall compliance culture with the expectation that banks will have strong governance frameworks to address compliance risk. They are looking for clear accountability structures from the board of directors down and effective compliance training programs for employees.

Anticipated trends highlight changing technology and shifting consumer expectations, reflecting the evolving landscape of bank consumer compliance. Staying at the forefront of these trends is fundamental for banks to maintain compliance and build trust with both customers and examiners.

Kelly Shafer, CPA, has over 19 years of experience in public accounting. As a member of the audit and consulting department of the firm, her primary focus has been on serving clients in the financial institution, higher education, governmental and nonprofit sectors. For more information, please contact Kelly Shafer at (304) 343-4126 or kshafer@suttlecpas.com.